The fundamental definition of how customers experience and interact with a #bank is being challenged and redefined, and leading companies face competition from a myriad of disruptors.

KPMG in its report “Setting Course in a disruptive market place” offers 5 Steps for a positive #DigitalTransformation to the financial institutions hoping to capitalize on rather than be crippled by — #disruption.

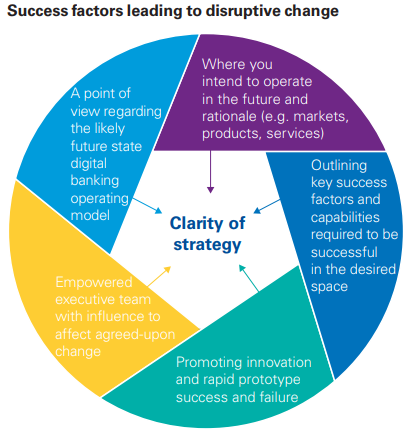

A positive digital outcome hinges on a clear and actionable #strategy. An effective strategy is difficult to produce given it must consider the bank’s customers, segments, geographies, relative competencies and focus. That said, a successful strategy includes a number of common elements and themes.

Common elements of a successful strategy

a. Consensus, or at a minimum, a point of view, regarding the likely future state digital banking operating model.

b. A clear view towards the customer and their desired experience, products and services.

c. Use the 9 Levers of Value* methodology to determine where to play and where to win.

d. Consensus regarding key performance factors and capabilities required to be successful in the desired space.

e. A culture promoting innovation and rapid prototype success and failure.

f. An empowered executive team with sufficient influence to affect agreed-upon change.

g. A clear vision and forward looking blueprint.